BankWest. User Research Transformed Mortgage Pricing Tool

Bankwest's mortgage pricing system was at a breaking point. Their support teams were overwhelmed with pricing requests while brokers faced constant rejections and delays. The Home Loan Pricing Tool needed a complete redesign to serve both internal teams and brokers effectively. To address these issues, Bankwest has initiated a project to redesign the Pricing Tool, focusing on streamlining the process, reducing rejections, and empowering brokers to submit high-quality pricing requests.

Research Strategy

To gain a comprehensive understanding of user needs and pain points, a mixed-methods research approach was employed. This approach combined qualitative and quantitative data gathering techniques to provide a holistic view of the problem and inform design solutions.

Business Dashboard Benchmarking: Data from the business dashboard was analyzed to establish baseline metrics for key performance indicators (KPIs) such as queue size, response times, and SLA compliance. This benchmarking process provided a quantitative understanding of the current state of the pricing request process and helped set targets for improvement.

Workshops: Workshops based on the Value Proposition Canvas were conducted with participants from both internal teams and brokers, representing different user archetypes.

The Value Proposition Canvas serves as a crucial tool for aligning the customer's job-to-be-done, the actions required to achieve specific outcomes, and the associated pain points and gains with the actual product features. This canvas effectively connects pain points and gains to potential solutions, enabling the generation of ideas for concrete product features or services that address these needs.

“The Value Proposition Canvas workshops establish a solid foundation for solutions that effectively address users’ needs.”

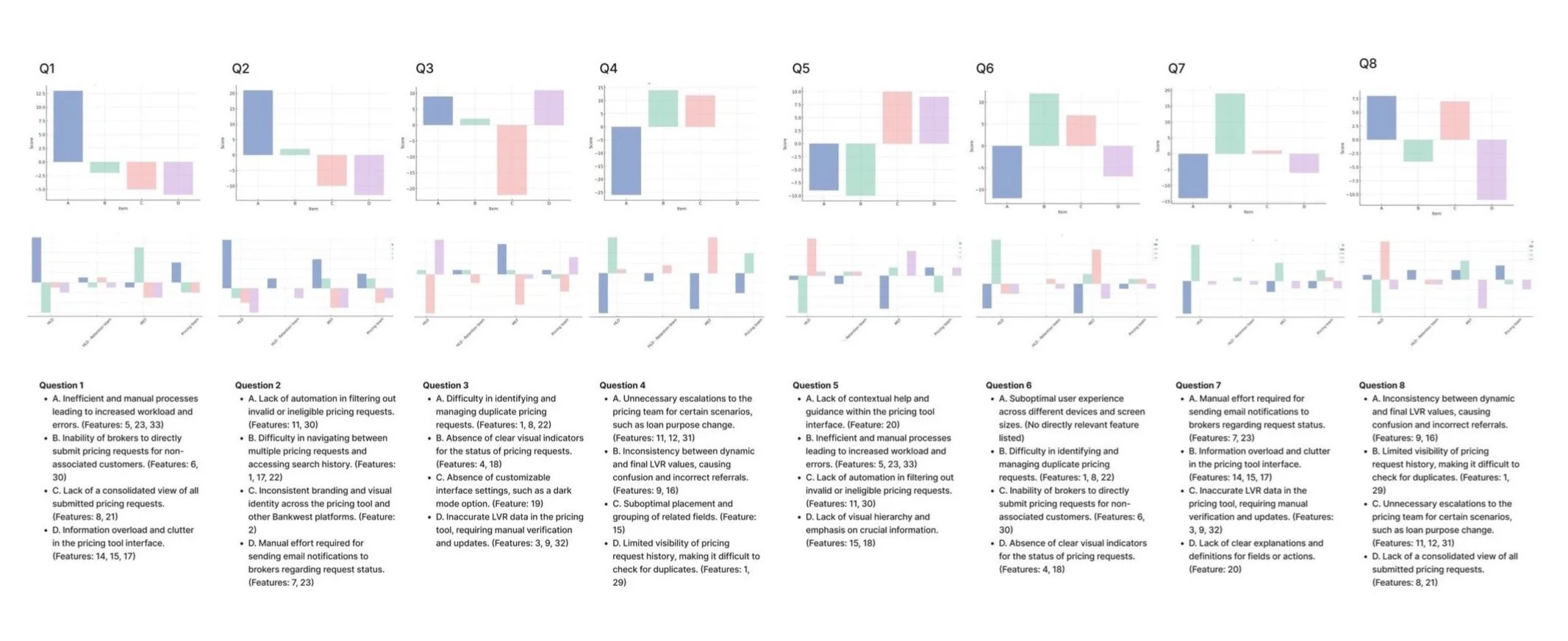

Survey: An online survey was conducted to collect quantitative data from a larger group of brokers and internal teams. The survey incorporated MaxDiff (Maximum Difference Scaling), a powerful technique for prioritizing user needs by identifying what mattered most and least to each user group. This data-driven approach ensured that design decisions were aligned with user priorities.

“Grounded in user insights and aligned with business goals, the discovery phase combined qualitative workshops, persona-driven surveys, and benchmarking to uncover challenges and refine pricing solutions”

Key Findings: Bottlenecks and Usability Challenges

The research phase revealed several key findings that highlighted the inefficiencies and user experience issues within the existing pricing tool

High Volume of Requests and Growing Queue Size: The internal team faced a significant increase in the volume of pricing requests, leading to growing queue sizes and pressure to meet the 48-hour SLA for responses. Delays in responses negatively impacted both broker and end customer experience.

Manual Effort Wasted on Declining Ineligible Requests: The internal team spent a considerable amount of time manually declining requests that were ineligible based on existing business rules. This manual process was inefficient and wasted valuable team resources.

Usability and Navigation Challenges: The tool's user interface lacked clarity, visual hierarchy, and intuitive navigation, hindering the team's productivity and negatively impacting the user experience

“The teams spend significant time and effort manually declining pricing requests that are ineligible based on current business rules”

The Sprint Framework

The design process was structured into four-week cycles, each focusing on critical aspects of the customer journey to address key pain points effectively. This iterative approach ensured that the design solutions were thoroughly tested and refined based on user feedback:

Ideation: Each cycle began with brainstorming and ideation sessions to develop solutions tailored to the identified issues.

Validation: Prototypes were developed and tested with users to validate the proposed solutions and refine them based on feedback.

The stakeholder showcases, held at the end of each four-week design cycle, were a vital part of the project. They were used to ensure that the design team and stakeholders were aligned on the design solutions and that the project had approval before moving to the next phase.

“The iterative nature of the process allowed the team to dive deep into design details and incorporate learnings from validation sessions in subsequent cycles, creating a continuous improvement process”

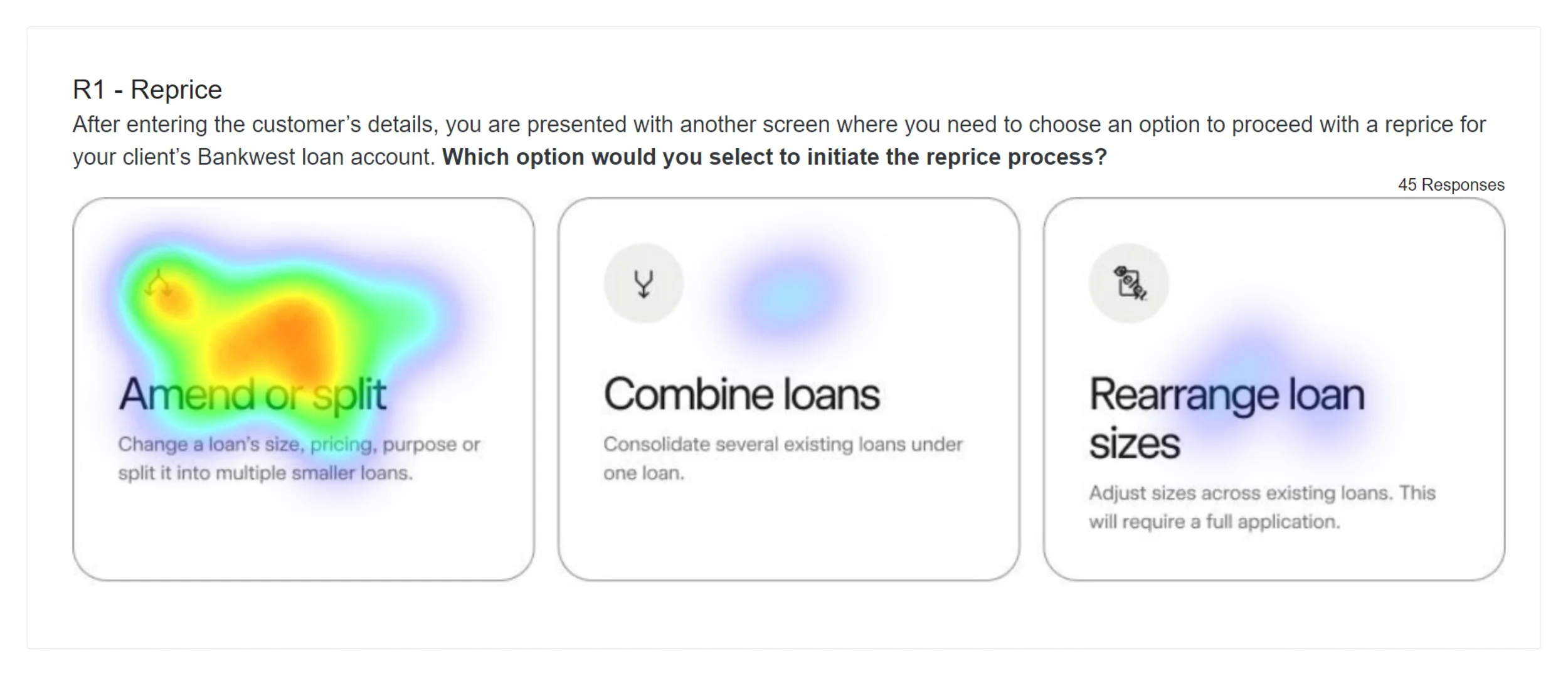

Heat-map and A/B Testing

User testing sessions were conducted with stakeholders, brokers, and subject matter experts (SMEs) to gather qualitative feedback. A Qualtrics survey with advanced features like heat-mapping and A/B testing was used to collect quantifiable data and compare different design approaches.

“Bankwest’s approach demonstrates the importance of gathering both qualitative and quantitative data through various methods.”

Key innovations

The data-driven sprints delivered four game-changing features:

Automated Ineligibility Filtering: The system automatically blocks ineligible pricing requests based on predefined rules, preventing them from reaching BankWest Broker Support Team and saving manual effort.

Smart Request Typing: Brokers choose loan characteristics, and the system intelligently determines the correct request type, eliminating manual selection and potential errors.

Customer Highlights: Tags and indicators quickly display key customer information, enabling the user to identify requests needing specific handling.

Streamlined Information: The redesigned information architecture presents loan details logically and includes important dates, facilitating faster and more informed decision-making.

Real-time Broker Guidance: Brokers receive immediate validation and guidance during the request process, reducing errors and rejections.

Scenario Comparison: Brokers can create and compare multiple pricing scenarios for the same customer, supporting better decisions and reducing revisions.

The new design allows brokers to select the characteristics of the loan based on their preferences, such as the loan amount, LVR, and loan purpose. The system then intelligently determines the appropriate request type based on the provided parameters ultimately streamlining the pricing request process and improving accuracy.

“Scenario creation and comparison empower brokers to optimize pricing requests and save time by reducing revisions and resubmissions.”

Measurable Impact

The implementation of the design solutions resulted in significant improvements across key metrics, demonstrating the success of the user-centered design approach:

Processing Time: Reduced by 67%, from 30 minutes to 10 minutes per request

Manual Interventions: Reduced by 80%, from an average of 25 to 5 per 100 pricing requests

Pricing Decision Accuracy: Increased by 13%, from 85% to 98%

User Satisfaction: Increased by 40%, from 3.2 out of 5 to 4.5 out of 5

“The measurable improvements demonstrate the success of the optimization project in reducing manual effort, minimizing errors, enhancing accuracy, improving user satisfaction, and increasing overall productivity. The metrics provide clear evidence of the tangible benefits achieved through the implementation of the proposed solutions”

Key Insights

The Bankwest Pricing Tool optimization project showcases the power of user-centered design in transforming complex processes into intuitive and efficient experiences. By prioritizing user needs throughout the research, design, and validation stages, Bankwest created a tool that empowers both brokers and internal teams to navigate the mortgage pricing process with ease and accuracy. The project's success is evidenced by the significant improvements in key metrics, reflecting the positive impact of a user-centric approach on business outcomes.

“The 4-week sprint structure enabled quick testing of assumptions and continuous refinement based on quantifiable user feedback. The result wasn’t just an improved tool - it was a validated framework for tackling similar challenges in financial service design.”